Michael Lewis on Ireland Crisis

.

Robert Vinall's fund website

contains lots of very insightful and instructive articles.

Warren Buffett's annual letter to Berkshire shareholders. This year includes a blurb from Charlie Munger.

The Education of a Value Investor, by Guy Spier. An extremely candid book about a person's journey towards being a better

and better value investor.

Stress Test, by Tim Gneithner. Probably the best first hand account of the financial stress ever to be written. It is eloquent and full of substance and thoughtful ideas for the problems of the financial world. However, I resented the way he dismissed Brooksley Born and her heroic efforts to reign in the derivatives industry in 1999.

How I Lost a Million Dollars. by Jim Paul. A candid story about a persons rise and fall betting in the Chicago Mercantile Exchange.

Interview with Allan Mecham., a rising star in the hedge fund world.

An entertaining article about the Kelly Criteron.

Friday, March 20, 2015

Monday, March 16, 2015

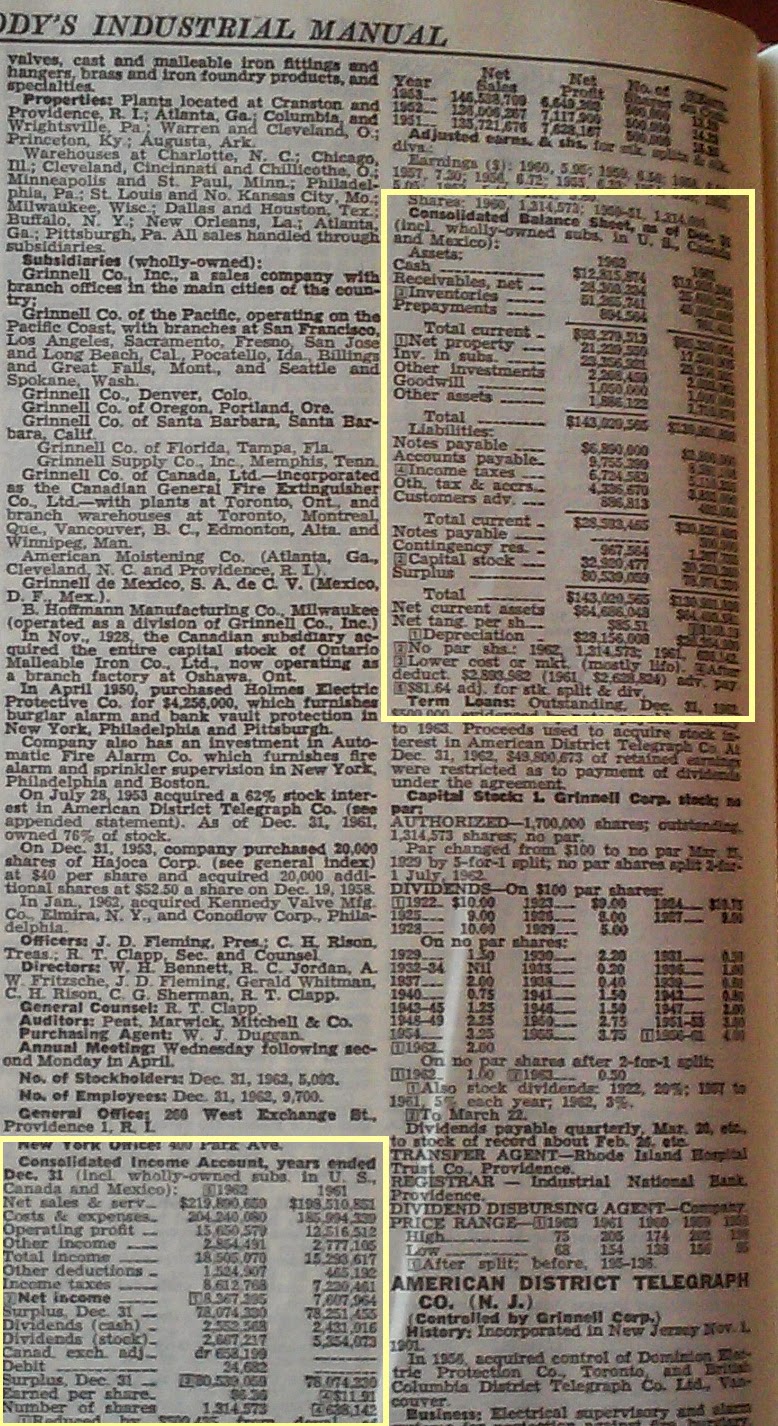

Buffett Partnership Investment: Grinnell Corp.

The 1962 Buffett Partnership had a 3% position in Grinnell Corp. Grinnell Corp at the time was a big player in the fire sprinkler and alarm business. It owned 76% of ADT. Today both companies are part of Tyco.

Interestingly back in 1960s it was mired in lawsuits with the government. The anti-trust authorities accused

the company and several subsidiaries of effectively forming a cartel. They collectively owned 87% of the central fire and alarm business. The court battle went all the way to the Supreme Court in 1964 where the company finally lost. By 1966 Grinnell had to divest ADT and two other subsidiaries. If I were Buffett, all this would not detract from the appeal of the company. In fact, all this tells me Grinnell was doing something right!

Below is the consolidated income statement and balance sheet from the 1963 Moody's Industrial Manual. The financials there do not include companies which are not wholly-owned subsidiaries. That would mean the financials exclude the full ADT financials. But what this in 1962 means to me is unclear. There are two ways to do this today. One is the equity method in which the income but not revenue shows up on the income statement. The other method is to exclude both income and revenue from the consolidated income statement, and instead just include the dividend paid to Grinnell as income. If it is the latter case then the income statement significantly under-reports income because Grinnell's share of income is $3.2M and its dividend is $1.1M, an understatement of $2.1M. If someone knows the answer please comment. In either case, the company group has great earning potential, and the balance sheet is also understated because it lists the value of all non-wholly owned subsidiaries at only $23M.

I understand the attraction of Grinnell in 1962.

| 1962 | Grinnell Corp |

| Price | $ 74.500 |

| Market Cap | $ 97.93 M |

| P/E TTM | 11.7 x |

| Div yield | 2.7 % |

| P/BV | 0.86 |

| ROE | 7.3 % |

| LT Debt/Equity | 0.00 |

Below is the consolidated income statement and balance sheet from the 1963 Moody's Industrial Manual. The financials there do not include companies which are not wholly-owned subsidiaries. That would mean the financials exclude the full ADT financials. But what this in 1962 means to me is unclear. There are two ways to do this today. One is the equity method in which the income but not revenue shows up on the income statement. The other method is to exclude both income and revenue from the consolidated income statement, and instead just include the dividend paid to Grinnell as income. If it is the latter case then the income statement significantly under-reports income because Grinnell's share of income is $3.2M and its dividend is $1.1M, an understatement of $2.1M. If someone knows the answer please comment. In either case, the company group has great earning potential, and the balance sheet is also understated because it lists the value of all non-wholly owned subsidiaries at only $23M.

I understand the attraction of Grinnell in 1962.

Saturday, March 14, 2015

Buffett Partnership Letters: Crane Co.

Crane Co. is the second company I am covering from the Buffett Partnership. Back in 1962 Crane Co. was 2% of the Partnership portfolio. It held $200k worth of shares.

Crane Co. (NYSE:CR) is still an independent company today with a $3.7B marketcap. Back in 1962 it manufactured mostly pipes and valves and heaters for industry. Crane Co. was like Alco It traded significantly below book.But being a capital intensive company it wasn't a net-net. And it was a netnet. Below is the company balance sheet from the 1963 Moody's Industrial Manual.

In terms of profits we'd expect Crane to be better than Alco because Crane is still alive today whereas

Alco was defunct by the end of the 1960s. The company's results looked a bit odd. The sales were highest in 1956 and then dipped before coming back in 1962. Income was

down from a high of $10.9 M in 1958 to $3.2 M by 1962.

Still it paid almost all the income out as dividends.

The 1950s and 1960s were a time of rapid expansion for the company. They acquired several companies over that time and the ups and downs may reflect the understandable problems during mergers. What is certain is that Crane was a player in the emerging industries of that time such as space and nuclear. And they have done alright because they are still around today. So maybe Buffett saw something in the growth prospects as well as the margin of safety on the balance sheet.

Crane Co. (NYSE:CR) is still an independent company today with a $3.7B marketcap. Back in 1962 it manufactured mostly pipes and valves and heaters for industry. Crane Co. was like Alco It traded significantly below book.

| 1962 | Crane Co. |

| Price | $ 40.250 |

| Market Cap | $ 51.7 M |

| P/E TTM | 18.2 x |

| Div yield | 5.0 % |

| P/BV | 0.39 |

| ROE | 2.1 % |

| LT Debt/Equity | 0.18 |

The 1950s and 1960s were a time of rapid expansion for the company. They acquired several companies over that time and the ups and downs may reflect the understandable problems during mergers. What is certain is that Crane was a player in the emerging industries of that time such as space and nuclear. And they have done alright because they are still around today. So maybe Buffett saw something in the growth prospects as well as the margin of safety on the balance sheet.

Monday, March 9, 2015

Seaboard Corp Reports Record Earnings

Peter Lynch said that an investor should keep tabs on his investments.

And this is why I make quarterly posts of my largest holdings. They

help me keep abreast of progress in the company. And they allow me

to periodically double check my investment thesis.

Seaboard is my second largest holding and luckily for me, its

stock has been on a tear for the last two years. The company is steadily expanding its

footprint in the food industry. But it's core business is still pork. And

Seaboard had its most profitable year

last year because of great results from the pork segment.

Revenue for 2014 was $6.47 B versus $6.67 B the previous year. Income was $0.37 B versus $0.21 B the previous year. So sales did not grow but profits grew to the highest ever on margin expansion. This margin expansion was all from pork. Pork revenue was $1.72 B versus $1.71 B the previous year. Pork income was $0.35 B versus $0.15 B the previous year. Pork's recent performance was confluence of favourable pork and corn prices. See below.

Corn is the largest component of pork feed and I believe corn price recently is part of a natural decline in commodity prices. Commodity prices are cyclical and the high oil, gold and food prices of the last several years have to go down by definition. Pork prices on the other hand had a temporary boost due to a widespread virus t.hat luckily did not affect Seaboard. As the chart shows pork prices are coming back down in the last few months. But I think the corn and feed price drops will more than offset that.

The other Seaboard segments were generally good. The company's interest in turkey producer Butterball did well reflecting similar dynamics with pork: higher product prices with lower feed prices. And the marine division broke even last year versus a $26 M loss in 2013. I feel the improved fuel costs should help the marine segment to be profitable in 2015.

| SEB | |

| Price | $ 4039.00 |

| Market Cap | $ 4725 M |

| P/E TTM | 12.9 x |

| Div yield | 0.0 % |

| P/TBV | 1.74 |

| ROE | 13.4 % |

| ROIC | 11.9 % |

Revenue for 2014 was $6.47 B versus $6.67 B the previous year. Income was $0.37 B versus $0.21 B the previous year. So sales did not grow but profits grew to the highest ever on margin expansion. This margin expansion was all from pork. Pork revenue was $1.72 B versus $1.71 B the previous year. Pork income was $0.35 B versus $0.15 B the previous year. Pork's recent performance was confluence of favourable pork and corn prices. See below.

|

| US Hog Farm Prices |

|

| US Corn Prices per Bushel |

The other Seaboard segments were generally good. The company's interest in turkey producer Butterball did well reflecting similar dynamics with pork: higher product prices with lower feed prices. And the marine division broke even last year versus a $26 M loss in 2013. I feel the improved fuel costs should help the marine segment to be profitable in 2015.

Sunday, March 1, 2015

Buffett Partnership Investment: Alco Products

To say Warren Buffett has had a productive business career would be an understatement. He has gone from a newspaper delivery boy to a young entrepreneur to a hedge fund manager to the CEO of one of the world largest companies. And he is arguably the world's most well-known and admired capitalist.

Today he is a big-time capital allocator, and probably the best in the world. But I am more interested in learning from him when he was a small-time hedge fund manager. Buffett started several partnerships to invest his and those of close friends and family starting in 1957. Eventually they grew and grew until 1969 when he shut them down and focused on running Berkshire Hathaway.

I think that the value investing world would benefit greatly if more case studies of his partnerships were available. Some blog articles exist and some books have written about them. Here I will add my first case study of one of his partnership investments from 1962: Alco Products. I found this company from a copy of a handwritten statement of Buffett's holdings from that year. Later, I will post links and resources about the partnerships.

The partnerships had a 1% position in this company. The name Alco originally stood for American Locomotive. The company made steam and diesel locomotives. Later it also produced nuclear energy. In 1964 the Worthington Corporation acquired Alco. The company became defunct in 1969, presumably because of poor sales. Alco's locomotives were later produced by other companies and derivative locomotives are still running in some developing countries.

The company is well past it's heyday. Buffett in those days used the Moody's manual as the guide to companies. Moody's provides condensed info much like yahoo finance does today but with more accurate and useful information. The following is from the 1962 Moody's Industrial Manual, page 1841. As the income section shows, Alco revenues from 1956 to 1961 decreased from $160M to $89M. I have no details on the reasons for the decline. But clearly this is a company in trouble. So, it is puzzling why Buffett owned this back then. I can only speculate. One possibility is that Buffett bought the stock in the 1950's when it was doing well and pared his position as the fortunes went south. It doesn't appear that the low price to book ratio compensates for the horrendous earnings trend. It is also possible that I have made a mistake and Buffett didn't own this company. If anyone knows more about this please comment. Thanks!

Today he is a big-time capital allocator, and probably the best in the world. But I am more interested in learning from him when he was a small-time hedge fund manager. Buffett started several partnerships to invest his and those of close friends and family starting in 1957. Eventually they grew and grew until 1969 when he shut them down and focused on running Berkshire Hathaway.

I think that the value investing world would benefit greatly if more case studies of his partnerships were available. Some blog articles exist and some books have written about them. Here I will add my first case study of one of his partnership investments from 1962: Alco Products. I found this company from a copy of a handwritten statement of Buffett's holdings from that year. Later, I will post links and resources about the partnerships.

| 1962 | Alco Products |

| Price | $ 19.250 |

| Market Cap | $ 33.77 M |

| P/E TTM | 36.6 x |

| Div yield | 1.0 % |

| P/TBV | 0.53 |

| ROE | 1.4 % |

| LT Debt/Equity | 0.25 |

The company is well past it's heyday. Buffett in those days used the Moody's manual as the guide to companies. Moody's provides condensed info much like yahoo finance does today but with more accurate and useful information. The following is from the 1962 Moody's Industrial Manual, page 1841. As the income section shows, Alco revenues from 1956 to 1961 decreased from $160M to $89M. I have no details on the reasons for the decline. But clearly this is a company in trouble. So, it is puzzling why Buffett owned this back then. I can only speculate. One possibility is that Buffett bought the stock in the 1950's when it was doing well and pared his position as the fortunes went south. It doesn't appear that the low price to book ratio compensates for the horrendous earnings trend. It is also possible that I have made a mistake and Buffett didn't own this company. If anyone knows more about this please comment. Thanks!

Subscribe to:

Comments (Atom)